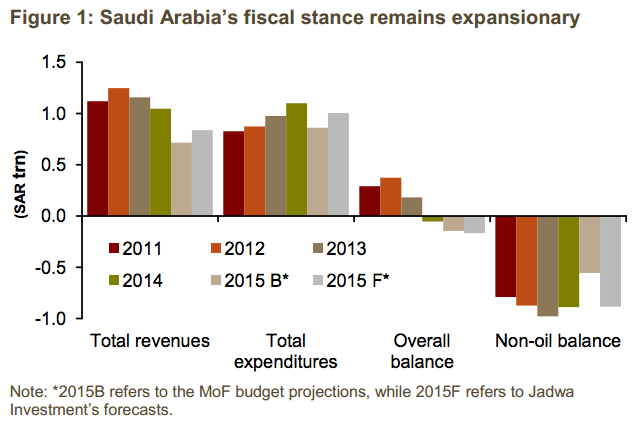

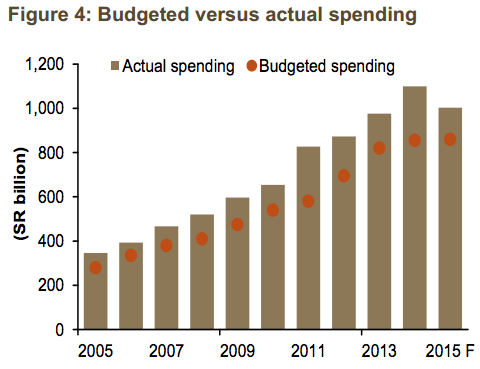

Saudi Arabia’s 2015 fiscal spending plans amount to “another expansionary budget with spending maintained at a very high level which will play a vital role in supporting the economy,” according to Riyadh-based Jadwa Investment. The firm notes that for the first time since 2011, a fiscal deficit is projected, based on revenues of SR715 billion and expenditures of SR860 billion.

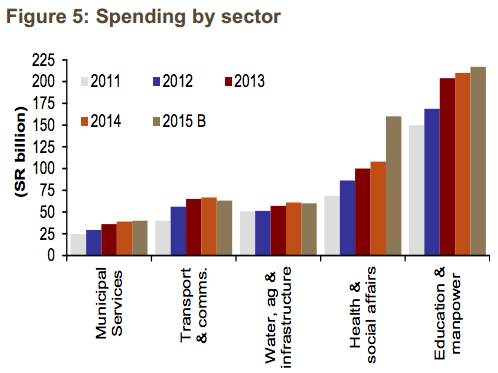

Education and training was allocated SR217 billion, a moderate 3 percent increase on 2014’s allocation, Jadwa notes.

“Education and healthcare remain the focus of government spending, accounting for 43.8 percent of total spending. The deficit will be financed comfortably using Saudi Arabian Monetary Agency’s huge stock of net foreign assets, which totaled $736 billion at the end of November. Domestic debt was cut to a long-term low of SR44.2 billion in 2014, equivalent to only 1.6 percent of GDP,” Jadwa writes.

“Despite the global environment of lower oil prices, the Kingdom maintains its counter-cyclical economic policy in the 2015 fiscal budget.”

On the revenue side, Jadwa anticipates that around 83 percent of total revenue will come from oil. “We calculate that oil production of 9.6mbpd at a price for Saudi export crude of $56pb (equivalent to around $60pb for Brent) and an oil export/revenue transfer ratio of 89 percent is consistent with the oil revenue projection in the current budget,” the firm said.