As the Coronavirus spread continues to decline in Saudi Arabia, fresh data from the from the Saudi Arabian Monetary Authority (SAMA) indicates some bright spots for Kingdom’s economy, according to Jadwa Investment.

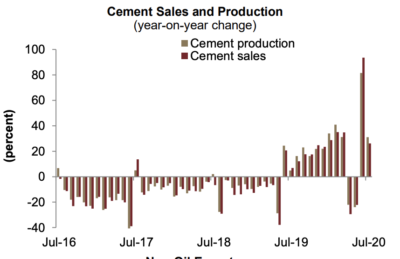

Cement sales and production continued to rise in July for the second consecutive month, by 26 and 31 percent year-on-year, respectively, indicating a pick-up in construction activity after

lifting of lockdown restrictions at the end of June, Jadwa Investment notes.

In July, Saudi Arabia’s POS transactions rose at a robust rate of 33.9% year-on-year. While this figure is a 15% month-on-month decline from the previous month, it is likely that a significant portion of the decline is attributable to the implementation of an increased value added tax from 5% to 15% which took place July 1st. July’s year-on-year increase is driven by the Food and Beverages, Restaurants and Hotels, and Clothing and Footwear segments of the economy, data show. However, more recent weekly data shows POS transactions slowed further in August, following a notable rise in the last week of July (which partly coincided with Eid Al-Adha holidays), Jadwa notes.

Credit to the private sector grew 13.2% year-on-year, while bank claims on public sector advanced 19% year-on-year and deposits grew by 9.4%year-on-year.

The data does show a mixed picture. The index of non-oil manufacturing declined by 22 percent year-on-year in June, and a breakdown of manufacturing industries shows that most manufacturers continued to see declining production in June, Jadwa reports.

Although SAMA reserves ticked slightly up by $0.6 billion month-on-month in July, to stand at $448 billion, the net monthly change to government accounts with SAMA showed a decline by SR9.6 billion ($2.56 billion) month-on-month in July. The breakdown shows the decline came mainly from a drop in government current deposits.

Oil exports for July were also down significantly as the Kingdom reigns in production along with OPEC+ members to stabilize the price of crude following a significant drop in March as the Coronavirus and a price war took hold. Latest available official data shows that Saudi oil exports for June averaged 5 mbpd, the lowest on record since Joint Organizations Data Initiative (JODI) data began in 2002, according to Jadwa.

Saudi Arabia’s stock market is still down about 5% year-to-date, but “a significant development (such as an announcement of resumption of international commercial air travel) could push the index closer to previous 2020 highs of 8500 points,” Jadwa said.

[Click to read the full report from Jadwa Investment] [Arabic]