Saudi Arabia’s sovereign wealth fund, the Saudi Arabian Public Investment Fund (PIF), has “about $300 billion in assets” now, a report has found, and its growing size is set to “improve the country’s international investment position.”

“We now estimate PIF’s assets at about $300 billion, of which one-fourth are invested abroad….Proceeds from privatization (a target of about $200 billion) and the eventual 5 percent sale of Aramco (a target of $100 billion) will further boost the PIF’s assets,” the Institute of International Finance (IIF) said.

The report says the Kingdom is still eying significant growth in assets from its current position in line with Vision 2030, targeting $400 billion in assets by 2020, and $2 trillion by 2030. With the forthcoming sale of SABIC from the PIF to Saudi Aramco, the Kingdom is likely to hit its $400 billion by 2020 target.

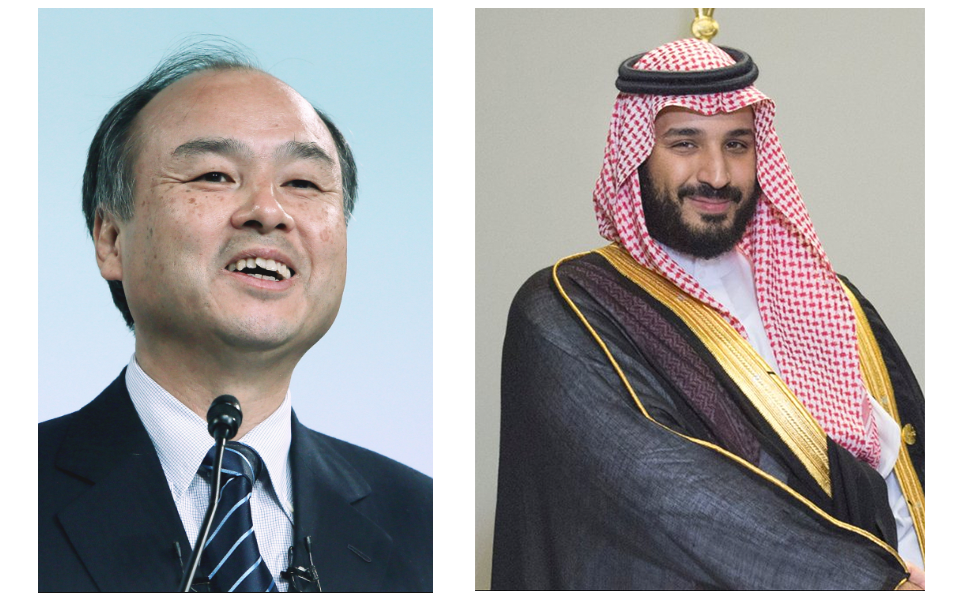

The report says roughly one quarter of the PIF’s holdings are overseas, with investments in companies like electric car maker Tesla, SoftBank’s Vision Fund, and many more.

The IIF estimate of the PIF’s holdings is slightly lower than that of the Sovereign Wealth Fund Institute, which estimates PIF’s current assets at $320 billion.

According to Arab News, the IIF report also found that Saudi Arabia’s holdings of US government bonds climbed to a peak of $170 billion in March 2019.