Saudi Arabia and Japan’s SoftBank Group will create a technology investment fund that could grow as large as $100 billion, making it one of the world’s largest private equity investors.

Softbank is creating a new global tech investment fund, seeded with $25 billion of its own money. The fund, which will be London, UK based — with a working title of the ‘Softbank Vision Fund’ — is also set to be bolstered with up to $45BN from the Public Investment Fund of Saudi Arabia, TechCrunch reports.

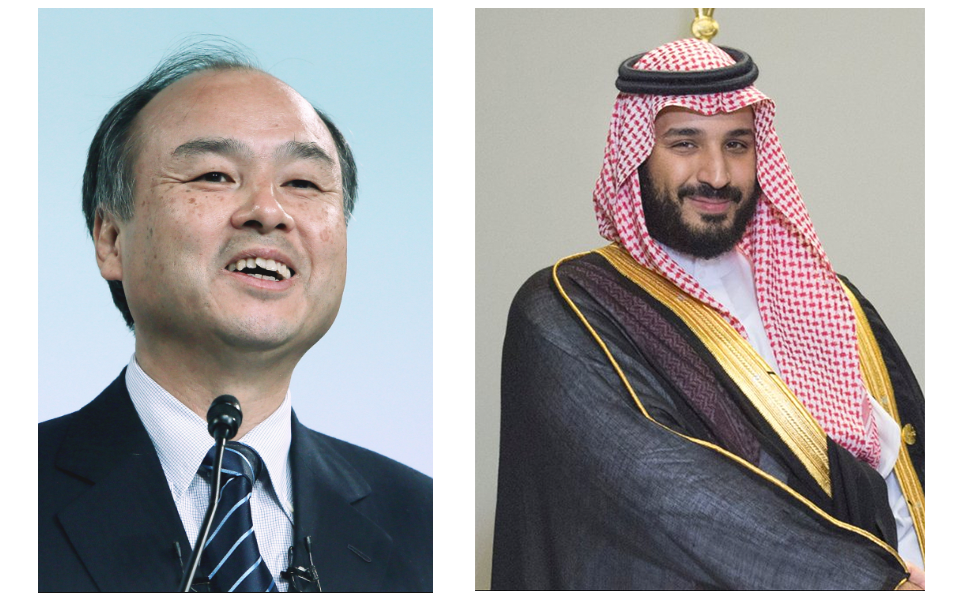

Softbank’s billionaire founder, Masayoshi Son, is looking to expand the company’s footprint worldwide. Softbank owns a telecommunications network in Japan and Sprint in the United States, and has made investments and acquisitions around the world. It is headquartered in Tokyo and ranks 62nd on the Forbes 2000 list of companies.

“The Public Investment Fund is focused on achieving attractive long-term financial returns from its investments at home and abroad, as well as supporting the Kingdom’s Vision 2030 strategy to develop a diversified economy,” Saudi Arabia’s Deputy Crown Prince Mohammed bin Salman said in a statement. “We are delighted to sign this MOU with SBG given the long history, established industry relationships and strong investment performance of SBG and Masayoshi Son.”

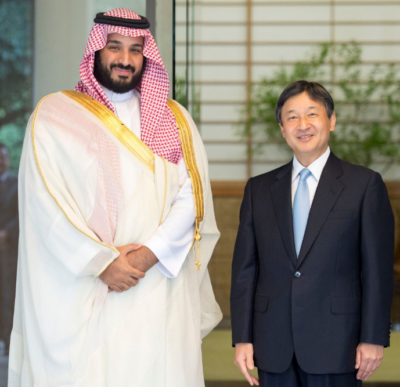

Deputy Crown Prince Mohammed bin Salman in Japan earlier this year.

Deputy Crown Prince Mohammed bin Salman has shown a keen interest in technology. After empowering Saudi Arabia’s Public Investment Fund to be a vehicle for capital investments into promising ventures with its Vision 2030 economic strategy, the powerful prince visited the United States and toured some of the largest technology companies in the world, including Facebook, Inc., in California.

At an annual rate of $20 billion, the new London-based fund could at current levels account for roughly a fifth of global venture capital investment, according to Reuters.