Saudi Arabia’s economy proved to be more resilient than expectations in the face of dual crises of the Coronavirus pandemic and a drop in oil prices in 2020, Jadwa Investment writes in an economic update.

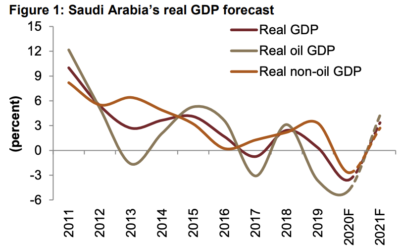

“At the same time, with no revisions to our oil GDP forecast (-4.8 percent), and a downward revision to government sector GDP, overall GDP in 2020 is expected to decline by 3.6 percent, marginally better than -3.7 percent previously,” the Riyadh-based investment firm noted. “Looking out into 2021, despite there still being a considerable degree of uncertainty as a result of the prevalence of COVID-19, and its potential impact on the non-oil economy, we do nevertheless expect a broad-based recovery next year. A less steeper decline than expected in Q2, and a stronger recovery in Q3 has led us to revise our non-oil GDP forecast for the Kingdom in 2020. All in all, we expect non-oil GDP to decline by 2.7 percent (compared to -3 percent previously).”

Saudi Arabia’s real GDP forecast. Graphic via Jadwa Investment.

The second half of 2021 is where much of the recovery will take place, Jadwa forecasts, allowing for time for vaccines to be distributed globally, once available.

On the oil side, Jadwa’s current forecast for Saudi crude oil production assumes OPEC+ adding an additional 1.9 million barrels per day (mbpd) to total output in January 2021. However, oil output “could well be lower than forecasted if the alliance tapers back part of the planned rise at an OPEC+ meeting next week.”

Jadwa says they now expect Saudi Arabia’s deficit to total SR298 billion ($79.46 billion, or -10.9 percent of GDP) in 2020, down from our previous forecast of -SR363 billion ($96.79 billion, or -13.4 percent of GDP). Overall, the main risk to Jadwa’s forecast relates to a second wave of COVID-19 occurring in the Kingdom before the roll-out of a vaccine, or indeed a delay in the current assumed timeline related to the roll-out of an effective vaccine.

“Not bad, all things considered,” Jadwa said of the Saudi economy.

[Click here to read the full report from Jadwa Investment] [Arabic]