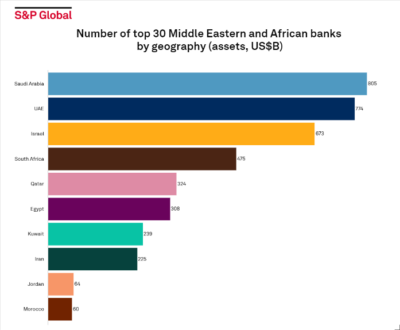

S&P Global’s latest ranking of the top 30 Middle Eastern and African banks by total assets finds Saudi institutions leading in both total numbers and total assets.

For this ranking S&P Global assessed company assets adjusted on a best-efforts basis for pending mergers, acquisitions and divestures, as well as the M&A deals that closed after the end of the period through March 31, 2023.

Saudi Arabia placed the most banks (7) in the top 30 and led in total assets ($805 billion).

Qatar National Bank topped the table, followed by First Abu Dhabi Bank, Saudi National Bank, Al-Rajhi Banking and Investment and Emirate NBD to round out the top five.

S&P Global noted that, “Al Rajhi Banking & Investment Corp. broke into the top five largest banks in the Middle East and Africa region after almost doubling assets over the past three years. The Saudi Arabian bank jumped five places to fourth in S&P Global Market Intelligence’s annual ranking, the highest climb of any lender in the past year.”

Adding, “Fellow Saudi banks Saudi British Bank, Banque Saudi Fransi and Arab National Bank also climbed in the ranking, while Saudi National Bank and Riyad Bank retained their respective third and 19th spots. Saudi banks are expected to extend more loans linked to mega-projects in 2023, although overall loan demand is set to decline.”

Interestingly, every Israeli bank fell in the ranking. Bank Hapoalim dropped four spots., Bank Leumi, Mizrahi Tefahot Bank, Israel Discount Bank and F.I.B.I. Holdings also dropped in the ranking.

Three banks entered the ranking: Iran-based Bank Pasargad ranked 20th, United Arab Emirates-based Mashreqbank PSC ranked 29th and Saudi Arabia-based Alinma Bank ranked 30th.

Middle East and Africa’s 30 largest banks by assets, 2023