“Saudi Arabia’s holdings in US treasuries increased for the fifth consecutive month, rising by 2.96 percent to $131.9 billion in December from November. Data released by the US Treasury Department placed Saudi Arabia at the 16th spot among the largest investors in such financial instruments in December. The report disclosed that in November, the Kingdom held bonds valued at $128.1 billion, compared to $117.5 billion and $117.1 billion in October and September, respectively.”

“At least 30 multinational law firms have opened branches in Saudi Arabia in the past nine months or have applied for the right to do so, racing to establish a foothold in the oil-rich kingdom now allowing outside legal work. Several had affiliations with Saudi-based firms since the early 2000s, but for the first time were allowed to create their own practices in the country without the constraints of a local partner. Others are entering the marketplace for the first time.”

“The Saudi Business Center provides, in one place, more than 750 services pertaining to 65 government agencies concerned with the business sector. This is through the center’s 17 branches spread over 14 cities throughout the Kingdom. The center’s digital business platform provides services of qualitative value, enabling investors and business owners to complete their economic business procedures.” Saudi Business Center to issue two instant commercial licenses for investors [Saudi Gazette]

“It’s like you’re trying to complete a Rubik’s Cube while running 100 miles an hour and sinking in quicksand. The degree of difficulty on that is just through the roof.” Frank Lowenstein, who served as a U.S. special envoy for Israeli-Palestinian negotiations during the Obama administration, Biden’s Grand Bargain to Remake the Middle East [Foreign Policy]

“Aramco is heavily investing in a trio of oil megaprojects at Zuluf, Marjan and Berri, along with infill drilling at its legacy fields to slow production declines. To increase capacity to 13 million b/d, other expansion projects such as Safaniyah and Manifa as well as the commercialisation of new discoveries are more than required. But costs have substantially increased since the pandemic and it makes less sense now for Aramco to go after projects that are getting more expensive when it doesn’t see opportunities to significantly increase production while prices are under pressure.”

Alexandre Araman, principal analyst, Upstream for Wood Mackenzie, Saudi Aramco’s shift to abandon its 13 million b/d capacity target likely to be absorbed by the market [Hellenic Shipping News]

“More than 20,000 participants from 125 countries, including a record 60% Saudi nationals, took part in the third edition of the Riyadh Marathon on February 10.”

Saudi Sports for All Federation Welcomes More Than 20,000 Participants for 2024 Riyadh Marathon

[Antara]

“This national security memorandum will give the Biden administration much more leverage to ensure that every recipient of U.S. military assistance, including the Netanyahu government, has to make the commitment to use those weapons in compliance with international humanitarian law.” Sen. Chris Van Hollen (Democrat, Maryland) praised a new National Security Memorandum issued by the President on Thursday that requires for the first time that countries receiving U.S. military aid provide written assurances in advance of receiving it that they will comply with international humanitarian law, and facilitate and not impede efforts to provide U.S.-supported humanitarian assistance to populations in conflict zones. National Security Memorandum on Safeguards and Accountability With Respect to Transferred Defense Articles and Defense Services [White House]

“Overall, the revised mandate represents a strategic response to market conditions, with implications for capex requirements, particularly in greenfield offshore developments. Despite the pause in capacity expansion, Saudi Arabia remains committed to maintaining its role in balancing the global oil market and ensuring supply stability. In summary, Saudi Arabia’s decision to maintain its maximum sustainable capacity at 12 million bpd reflects a nuanced response to market dynamics, with implications for future investments, the composition of its oil mix, and offshore activities.”

Rystad Energy Analyzes Saudi Arabia’s Pause in Oil Capacity Expansion Amid Market Uncertainty: Implications for Offshore Projects and Supply Stability [Solar Quarter]

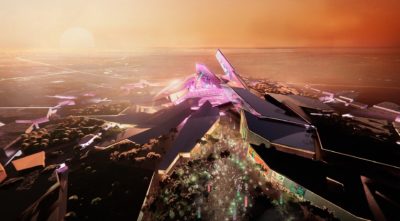

“I think [joining] the program [GCAP] is important to Saudi Arabia and it’s managed by MoD. And we are part of that from the localization point of view. There is a serious discussion [as] Saudi Arabia is very keen on the sixth-generation fighters, and we are talking to the UK their partners and we are making good steps forward.” Ahmad Al-Ohali, the governor of the Saudi government’s General Authority for Military Industries (GAMI), said in an interview at this week’s World Defense Show. Saudi Arabia ‘keen’ to join GCAP fighter program, but localization a must: GAMI governor [Breaking Defense]

“Even though the Houthis have attacked no China-owned ships, leaders in Beijing have become increasingly concerned about the economic costs of the Iran-endorsed Houthi attack campaign. China’s companies depend on the free flow of goods between China and Europe. The Houthi attacks have caused the cost to ship a standard 40-foot container from China to northern Europe to jump from $1,500 to $4,000, according to the Kiel Institute for the World Economy in Germany.”

Houthi Attacks Upend Beijing’s Regional Strategy [Soufan Center]