The latest Middle East Economy Watch quarterly report by PWC examined the economic impact of the VAT roll out in the UAE and Saudi Arabia, noting that “with some caveats, the early data suggests that the inflationary impact of the tax has been contained, the impact on growth is limited and in Saudi Arabia it has raised more revenue than was initially expected.”

With one year passed since Saudi Arabia and the UAE became the first Gulf states to implement VAT, the initial data suggests that the new tax policy has been “relatively successful in diversifying government revenue without producing excessive inflation,” PWC said.

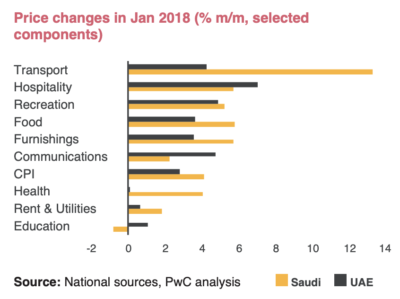

Graphic via pwc.com/

Following the implementation of VAT’s introduction, prices in many sectors declined on average during the rest of the year until November (the most recently available month), according to PWC. “This seems to suggest that, so far at least, there has been little secondary inflation.”

It will take a couple of years before the impact, including secondary and indirect effects, can be fully assessed. The rollouts in the UAE and Saudi Arabia created “teething” problems which need to be ironed out, PWC said, but this should help VAT implementation in the remaining Gulf states.

[Click here to download and read the full PWC Middle East Economy Watch report]